Underwriting in real estate plays a pivotal role in the success of property transactions in real estate. Whether it’s acquiring a mortgage for a residential property or securing financing for a commercial development, underwriting in real estate serves as a critical process that assesses the risk and viability of a real estate investment.

In this blog post, we will present a comprehensive overview of underwriting in real estate, shedding light on its significance, the critical components involved, and the underwriter’s role. From examining property appraisals and evaluating borrower creditworthiness to analyzing financial statements and estimating loan-to-value ratios, we explore the essential elements of underwriting that shape the landscape of real estate financing. Let’s begin!

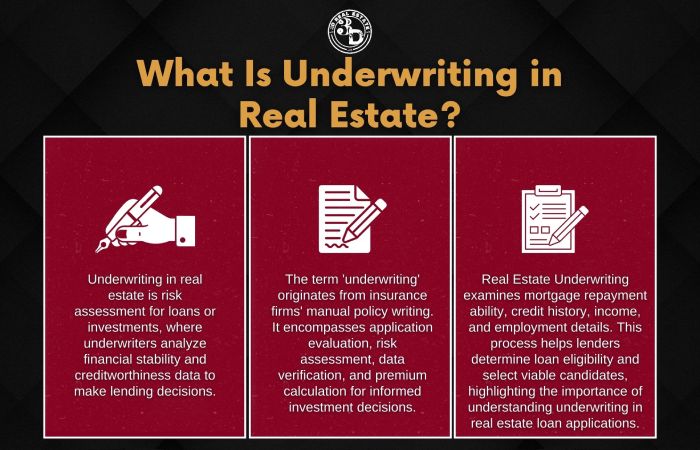

What Is Underwriting?

Underwriting is an essential part of the real estate process. It refers to assessing the risk associated with a loan or investment. Underwriters evaluate data related to applicants to determine if they will be approved for financing, what type of product they are eligible for, and at what cost. It’s the underwriter’s job to review all documents supplied by the borrower, analyze financial stability and creditworthiness, and ensure all regulations have been met.

The term “underwriting” comes from insurance companies that used to manually write their policies on paper using a pen (the ‘pen’ being called an underwriter). The modern practice of underwriting encompasses many tasks, such as evaluating applications, assessing risks, verifying information provided by borrowers, and calculating premiums. In addition, it allows lenders to make informed decisions about potential investments based on reliable statistics.

Underwriting in real estate involves looking at a person’s ability to pay off their mortgage over time, analyzing credit history, income proof, employment details, etc. Taking into account these factors helps lenders decide whether or not someone qualifies for financing. Lenders can confidently choose viable candidates by considering each applicant’s background information. Understanding the importance of underwriting is vital when assessing a loan application in real estate.

Role of the Underwriter

The underwriter’s role in real estate is to evaluate a loan or investment’s financial viability and risk. As such, there are several duties that an underwriter must fulfill to ensure that all parties involved in a transaction have protection against potential losses. These include:

- Analyzing creditworthiness and determining whether a borrower has adequate income to meet repayment obligations.

- Conducting due diligence on any collateral for security purposes, including appraisals and title searches.

- Investigating current market trends and ensuring compliance with relevant regulations and laws governing investments and lending activities.

- Assessing risks associated with a given loan or investment, considering factors such as interest rate fluctuations, inflationary pressures, political stability, etc.

Underwriters should possess strong analytical skills and knowledge in finance, accounting, economics, law, and real estate markets to perform their job competently. They need to be able to assess various types of information while maintaining accuracy quickly. Additionally, they should demonstrate excellent communication skills to accurately explain their findings to interested parties needing help understanding complex financial concepts or terminology related to investing or financing transactions involving real estate properties.

Given its responsibility for evaluating financial data associated with a proposed loan or investment opportunity before approval by lenders or investors, it is clear why having qualified professionals performing this task is essential for successful transactions involving real estate assets. With proper oversight from experienced underwriters, organizations can better protect themselves from making bad decisions when dealing with high-value investments.

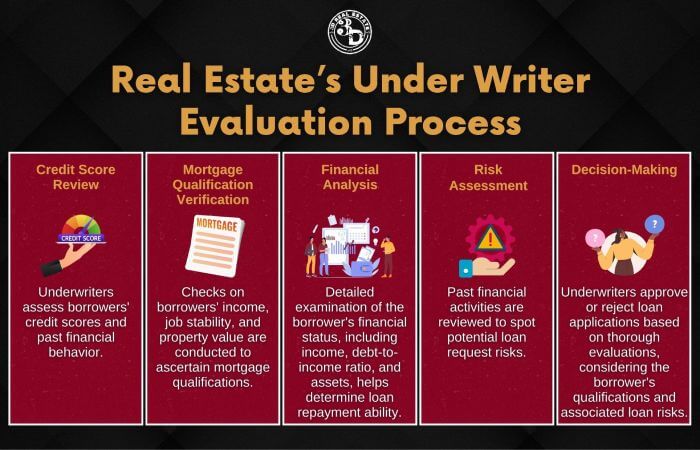

Evaluation Process of Underwriting in Real Estate

The evaluation process for underwriting in real estate involves several key steps to assess the borrower’s creditworthiness and determine the feasibility of approving a loan application. Here is an overview of the typical evaluation process:

- Credit score and risk assessment

The underwriter begins by reviewing the borrower’s credit score, which provides an indication of their creditworthiness. A higher credit score generally signifies a lower-risk borrower. The underwriter also assesses the borrower’s credit history, including any previous delinquencies, bankruptcies, or foreclosures.

- Mortgage qualification analysis

The underwriter verifies whether the borrower meets all the necessary mortgage qualifications. This includes assessing factors such as the borrower’s income, employment stability, and the property’s appraised value. The underwriter ensures that the loan application adheres to the specific requirements and guidelines set by the lender or investor.

- Financial analysis

Underwriters evaluate the borrower’s financial situation comprehensively. They consider various metrics, including the borrower’s income, debt-to-income ratio, employment history, assets, and liabilities. The underwriter assesses the borrower’s ability to repay the loan by analyzing their income stability, level of debt, and financial reserves.

- Risk assessment

Underwriters may conduct a risk assessment by reviewing the borrower’s past transactions and financial behavior. They examine factors such as the borrower’s payment history, previous loan defaults, and overall financial management. This analysis helps identify any potential risks associated with the loan request or the applicant’s profile.

- Decision-making

Based on the thorough evaluation of the borrower’s creditworthiness, mortgage qualifications, financial situation, and risk assessment, the underwriter makes an informed decision on whether to approve or reject the loan application. The underwriter considers if the borrower meets all the prerequisites for loan approval and evaluates the overall risk associated with granting the loan.

It’s important to note that the evaluation process may vary slightly depending on the specific lender’s policies, loan program, and the complexity of the transaction. However, the fundamental objective remains the same, which is to assess the borrower’s eligibility and determine the likelihood of successful loan approval.

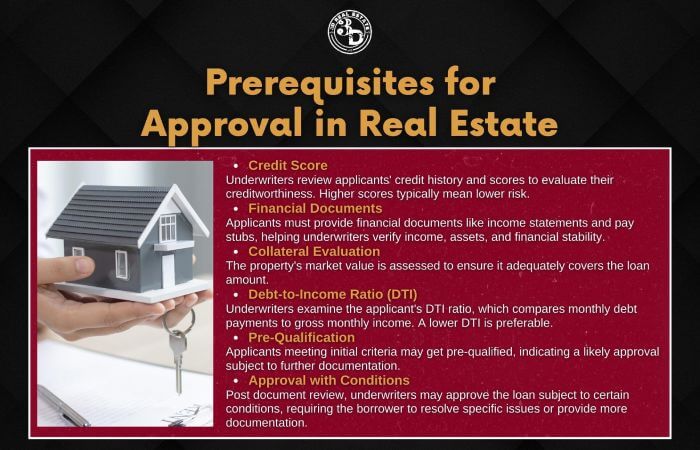

Prerequisites for Approval

Underwriting in real estate is the process of evaluating a borrower’s application for a loan. Underwriters are crucial in determining whether an applicant qualifies for a mortgage loan and assessing their ability to repay it. Underwriting in real estate involves examining various criteria and qualifications to make an informed decision.

Here are some critical aspects of underwriting in real estate prerequisites for approval:

- Credit Score

Underwriters typically review the applicant’s credit history and credit score to assess their creditworthiness. A higher credit score points out a lower risk for the lender, increasing the chances of loan approval.

- Financial Documents

Applicants are required to provide financial documents such as income statements, asset statements, and pay stubs. These documents help underwriters verify the applicant’s income, assets, and financial stability.

- Collateral Evaluation

Underwriters assess the value of the property being purchased or used as collateral for the loan. The property’s appraisal helps determine its market value and ensures it sufficiently covers the loan amount.

- Debt-to-Income Ratio (DTI)

The underwriter evaluates the applicant’s DTI ratio, which compares their monthly debt payments to their gross monthly income. A lower DTI ratio is generally favorable, demonstrating a borrower’s ability to manage their debts.

- Pre-Qualification

Applicants who meet the initial criteria may receive pre-qualification for the mortgage loan. Pre-qualification indicates that the borrower is likely to approve but still requires further documentation and verification.

- Approval with Conditions

After reviewing all the necessary documents, underwriters may approve the loan application with certain conditions. These conditions may require the borrower to address specific issues or provide additional documentation before final approval.

Collaborating with a real estate agent during the underwriting process can be advantageous. They assist borrowers in understanding the required documentation and help gather the necessary information. They can also facilitate communication between the borrower and the lender, ensuring a smoother process.

Benefits to the Buyer

Underwriting in real estate plays a vital role in the real estate market, benefiting buyers in various ways. From increasing loan approval chances to providing financial security, underwriting empowers buyers with knowledge and guidance, creating a competitive environment that ensures fair pricing and informed decisions. Here are the detailed explanations of how underwriting in real estate benefits buyers:

- Increased Loan Approval Chances: Underwriting in real estate helps buyers increase their approval chances. Underwriters evaluate the buyer’s financial information, credit history, and other relevant factors to determine their creditworthiness. By going through the underwriting process, buyers can address any issues or improve their financial situation to meet the lender’s requirements, thereby increasing their chances of loan approval.

- Enhanced Purchasing Power: Underwriting in real estate gives buyers a clearer understanding of their financial capabilities. By assessing their income, assets, and liabilities, underwriters can determine the maximum loan amount the buyer can afford. It helps buyers identify their purchasing power and set a realistic budget when searching for a property, enabling them to make more informed decisions.

- Financial Security: Underwriting in real estate offers buyers financial security when considering real estate options. Underwriters analyze the property’s value, market conditions, and other relevant factors to assess the risk associated with the purchase. It protects buyers from potential fraud or issues arising during the transaction, ensuring their investment is secure.

- Guidance and Expert Advice: Underwriters can guide buyers through purchasing a property. They can provide valuable insights into the real estate market, helping buyers evaluate potential properties and identify any risks involved. In addition, underwriters stay updated with current market trends and conditions, offering advice to increase the buyer’s confidence in their investment decision.

- Competitive Pricing and Access to Financing: Underwriting in the real estate market encourages sellers to list their properties at competitive prices. When buyers have improved access to financing resources and increased confidence in their ability to secure a loan, sellers can attract more potential buyers, leading to a more competitive market. It benefits buyers and sellers by ensuring fair pricing and healthy growth in the housing industry.

Overall, underwriting in real estate benefits buyers by increasing their loan approval chances, enhancing their purchasing power, providing financial security, offering guidance and expert advice, and contributing to a competitive real estate market. These advantages empower buyers to make informed decisions and create a favorable environment for buyers and sellers in the housing industry.

Impact on the Real Estate Market

Underwriting in real estate has a significant impact on the real estate market. As a result, investors and lenders must understand how underwriting in real estate affects property values, market trends, and real estate policies.

The table below demonstrates the various ways that underwriting in real estate can affect the real estate market:

| Impact | Real Estate Market | Property Underwriting |

| Value Appreciation/Depreciation | Influences type of development/construction within markets. It can lead to over-construction in certain areas leading to an increase in supply but a decrease in demand resulting in low sales prices. | Directly influences an individual property’s value due to the appraisal process.It can also create opportunity costs if done incorrectly. |

| Market Trends | Provides insight into which areas are desirable from an investor standpoint.Informs government entities about environmental issues related to development projects. It helps generate data for insurance companies pricing premiums accordingly for different locations and types of homes. | Provides insight into which areas are desirable from an investor standpoint.Informs government entities about environmental issues related to development projects. It helps generate data for insurance companies pricing premiums accordingly for different locations and types of homes. |

| Policies Established | Provides insight into which areas are desirable from an investor standpoint.Informs government entities about environmental issues related to development projects.It helps generate data for insurance companies pricing premiums accordingly for different locations and types of homes. | Determines what kinds of loans will be offered by financial institutions.Identifies risks associated with each loan issued so proper compensation can be secured.Influences laws governing homeownership. |

Underwriters play a critical role in influencing the real estate market. By assessing properties, evaluating current conditions, identifying risks involved with investments, and setting standards for acceptable levels of lending criteria – they help keep the wheels turning in this industry. Moreover, the decisions made by these professionals have ripple effects throughout society as they ultimately shape economic policy decisions while helping people obtain financing options needed to purchase their dream homes.

Bottom Line Of Underwriting in Real Estate

Underwriting in real estate is an integral part of the real estate market. It helps protect buyers by ensuring they are in a sound financial position before taking on the obligations of homeownership. In addition, underwriters evaluate the borrower’s credit history and current financial situation to determine if they’re qualified for approval. As a result, potential buyers will receive numerous benefits from loans, such as lower interest rates and more favorable terms.

At 3D Real Estate, we understand the significance of underwriting in safeguarding the interests of potential homebuyers. We prioritize your financial well-being and aim to provide you with the best loan options. So take the first step to achieve your dream home. Contact us today for a personalized underwriting experience that puts your needs first.