Real estate brokers are essential facilitators in property transactions, playing a vital role as intermediaries between buyers and sellers. However, just like professionals in any field, real estate brokers can encounter situations where they must bear expenses or pay specific fees. Understanding these scenarios is crucial for brokers to navigate their financial responsibilities effectively.

In this blog post, we will present the various situations where real estate brokers may find themselves obligated to make payments. By exploring these scenarios, we aim to shed light on the financial aspects of the real estate brokerage profession and help brokers navigate potential expenses they may encounter.

What Is a Real Estate Broker?

A real estate broker is a person or business entity that acts as a middleman between buyers and sellers of real property. Brokers are responsible for understanding local, state, and federal laws regarding buying and selling real estate and regulations that govern their profession. In addition, they advise both parties on pricing, financing options, negotiation strategies, market conditions, and other related issues.

To become licensed in most states, brokers must pass written examinations that cover various aspects of the field, including legal terminology, contract law, finance principles, marketing techniques, fair housing practices, and basic real estate principles. In addition to being knowledgeable about these topics, a broker needs to stay informed on current trends to advise clients appropriately.

The role of a real estate broker can be quite complex; they need to understand all facets of purchasing or selling property while adhering to applicable rules and regulations. As such, they must have excellent communication skills to mediate negotiations between buyers and sellers while providing objective assessments at every stage of the transaction process. With this knowledge base and experience in the industry, brokers can help guide clients toward successful deals that meet everyone’s needs, including identifying the best place to buy land.

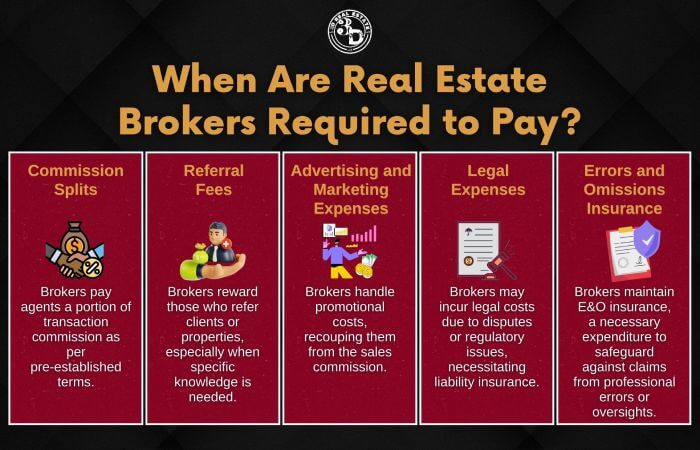

When Are Real Estate Brokers Required to Pay?

There are various instances when real estate brokers may be required to pay certain expenses or fees. Let’s explore some of these scenarios:

- Commission Splits

One of the most common obligations for real estate brokers is to pay commission splits to their agents or salespeople. Commission splits are predetermined percentages of the total commission earned from a real estate transaction allocated to the broker and agent. These splits are typically based on the agreement between the broker and the agent. They are considered a standard practice in the industry.

- Referral Fees

Real estate brokers may also be required to pay referral fees to other brokers or agents who refer clients or properties. Referral fees are typically a percentage of the commission earned from the referred transaction. This arrangement is typical when a broker needs to gain specific expertise in a particular market or geographic area and relies on the expertise of another broker to complete the transaction successfully.

- Advertising and Marketing Expenses

Sometimes, real estate brokers may be responsible for covering advertising and marketing expenses. It includes costs associated with promoting listings, such as professional photography, staging, online marketing, and print advertisements. These expenses are typically recouped from the commission earned when the property is sold.

- Legal Expenses

Real estate brokers may encounter legal issues related to their professional activities. In such cases, they may be required to pay for legal expenses, including attorney fees, court costs, or settlements. Legal issues may arise from client disputes, contractual disagreements, or regulatory violations. Brokers need to have professional liability insurance to help cover these potential costs.

- Errors and Omissions Insurance

Real estate brokers are often required to carry errors and omissions (E&O) insurance, also known as professional liability insurance. This insurance covers claims arising from errors, negligence, or omissions during their professional duties. Premiums for E&O insurance are typically paid by the broker and are considered a necessary cost to protect against potential liabilities.

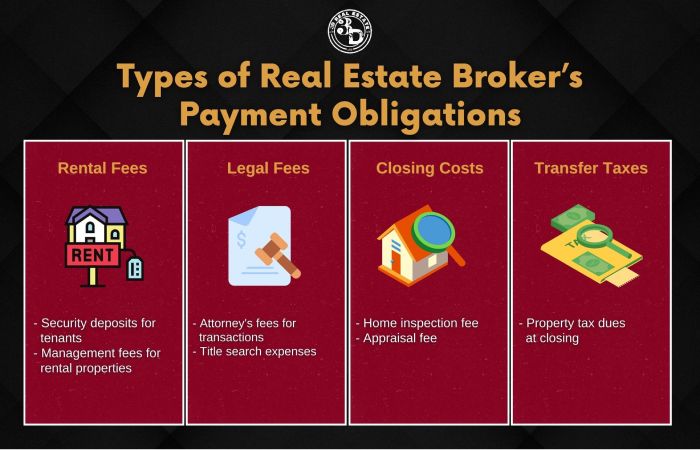

Types of Payment Obligations

Real estate brokers must often pay various fees and costs related to their services. These include mortgage payments, rental prices, legal fees, closing costs, and transfer taxes. Most mortgage payments are due when the loan is officially closed on a property. This payment goes towards the home’s total purchase price or other real estate investment. Different types of fees that a real estate broker may require include:

Rental Fees:

– Security deposits for tenants

– Management fees for rental properties

Legal Fees:

– Attorney’s fees for transactions

– Title search expenses

Closing Costs:

– Home inspection fee

– Appraisal fee

Transfer Taxes:

– Property tax dues at closing

In addition to these costs, real estate brokers should comply with all applicable statutes and regulations to protect themselves and their clients from potential liability issues.

Compliance With Laws and Regulations

Real estate brokers must comply with all relevant laws, regulations, and industry norms when conducting property transactions. It ensures that every aspect of the marketing is handled correctly to protect the client’s interests. It also helps them avoid any potential legal or financial repercussions due to non-compliance.

Real estate brokers must familiarize themselves with local, state, and federal laws about property transactions and professional organizations’ guidelines concerning broker compliance. For example, they should be aware of payment requirements such as escrow fees and taxes associated with each type of sale or lease agreement they are dealing with. Additionally, they must understand how these payment obligations apply to buyers and sellers in different scenarios so they can adequately advise their clients on the best course of action.

Sometimes, a real estate broker may be required to pay fees for a particular transaction out of pocket if their client does not have the funds available. Therefore, brokers must ensure sufficient funds are in their business accounts before beginning negotiations on behalf of their clients. By being mindful of these laws and regulations surrounding payments during a real estate transaction, brokers can ensure that everything proceeds smoothly from start to finish.

Dispute Resolution Processes

Several processes may be employed to resolve a dispute between a real estate broker and other parties, such as clients or lenders. These methods will vary depending on the specific circumstances and which parties are involved. However, real estate brokers must understand their payment obligations and comply with applicable laws in all cases.

The following table outlines some common types of dispute-resolution processes.

| Dispute Resolution Process | Description | Examples |

| Mediation | A voluntary process where an impartial third party helps facilitate communication between two disputing parties to reach a mutually agreeable outcome. | Negotiation sessions, arbitration hearings, court-appointed mediators (e.g., settlement conferences) |

| Arbitration | An informal hearing is conducted by an independent arbitrator who makes decisions based on the evidence presented by both sides in the dispute. This decision is legally binding upon both parties. | Commercial disputes over goods/services purchased/sold; contractual disagreements between employers/employees |

| Litigation | Formal legal proceedings are conducted before a judge or jury. The outcome of this process is final and cannot be appealed unless new evidence surfaces later that could overturn the ruling. | Property line disputes; contract breach claims; landlord-tenant disputes |

Real estate brokers must remain abreast of their payment obligations under any agreement they enter into, as disregarding them can lead to severe consequences if nonpayment occurs. Understanding available dispute resolution processes can help ensure these situations are resolved reasonably and efficiently without costly litigation. However, financial implications from nonpayment may ensue with proper preparation and compliance with applicable laws.

Potential Consequences for Non-Payment

Real estate brokers who fail to pay fees may face serious consequences. Regulatory fines, professional liability, and financial penalties are all potential outcomes resulting from nonpayment of dues or commissions for services rendered. Furthermore, there is always the possibility of incurring court costs to resolve a payment dispute.

If one fails to remit an agreed-upon fee, they risk being subject to disciplinary action by state regulatory agencies. It can include suspension or revocation of a license and denial of future applications until any outstanding payments have been addressed. A broker’s reputation within their community can also be damaged if such actions occur.

Real estate brokers need to understand the severity of not paying their dues on time or at all. Such behavior can lead to negative repercussions beyond the economic cost, so they should plan accordingly to ensure timely payment. In addition, clear communication between parties about expectations and deadlines should help ensure future understanding regarding payment obligations.

The Bottom Line

It is crucial to comprehend when you may be required to pay for professional services. Depending on the situation, payment obligations can range from paying taxes and fees to participating in dispute resolution processes. Brokers must also comply with all applicable laws and regulations; failure could result in serious penalties.

Understanding your financial responsibilities as a real estate broker is crucial in ensuring successful transactions and client satisfaction. Consult an expert if you still need to determine whether payment needs to be made. Also, an established process for handling disputes can help avoid costly issues.

At 3D Real Estate, we recognize the importance of transparency and clarity when it comes to financial responsibilities in real estate transactions. Contact us today to gain a thorough understanding of your payment obligations and how we can assist you in navigating this aspect of the process.